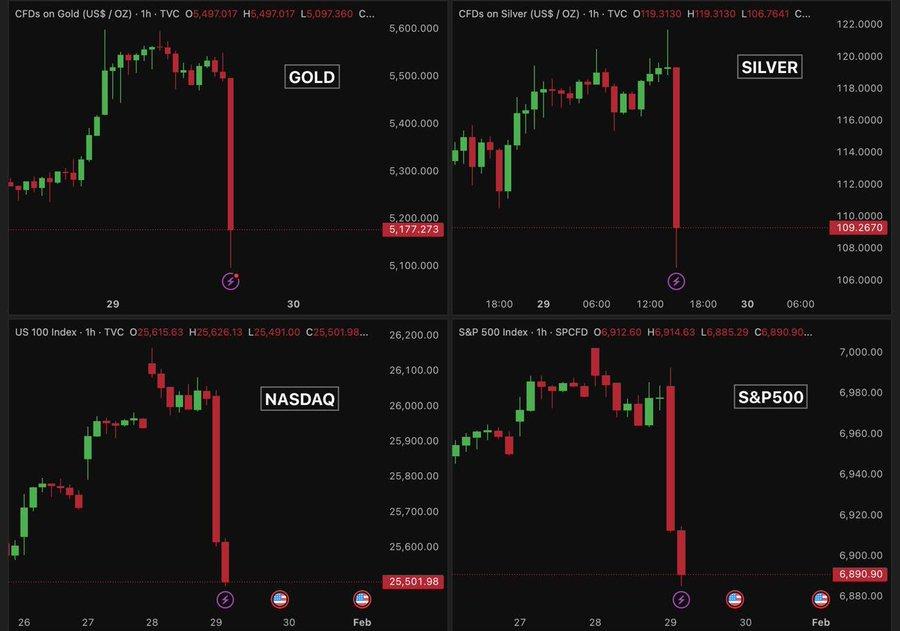

Last week and into the start of February 2026, global markets saw an unusual and dramatic slide in both cryptocurrencies and precious metals:

- Bitcoin and major cryptos have plunged sharply, with BTC sliding to lows not seen since mid-2025.

- Gold experienced steep drops — down double digits in some sessions — after recent all-time highs.

- Silver’s tumble was historic, with falls exceeding ~30–36% in a single trading session — its largest sell-off in decades.

- Analysts estimated trillions wiped out across metals and crypto as panic selling rippled through markets.

This alignment — crypto and traditional safe-haven assets simultaneously tanking — is rare and noteworthy.

Why this happened

1. Macro & monetary policy shifts

One of the biggest triggers was changing expectations around U.S. monetary policy:

- News of a potential new Federal Reserve chair nomination (e.g., Kevin Warsh) boosted expectations of less dovish policy, which strengthened the U.S. dollar.

- A stronger dollar makes commodities priced in USD — like gold and silver — more expensive to foreign buyers, pressuring demand and prices.

This also affected risk assets including crypto — a stronger dollar and tighter rate expectations reduce liquidity and speculative interest.

2. Forced liquidations & margin events

Both crypto and metals saw cascade effects from leveraged positions:

- In crypto, massive long liquidations accelerated selling pressure.

- In silver, sharp increases in margin requirements by exchanges forced traders to unload positions quickly, deepening the plunge.

In markets where a lot of action is driven by leverage, once prices begin falling, forced selling can snowball.

3. Profit-taking after big rallies

Both gold and silver had surged in late 2025, with record or near-record highs after prolonged rallies. Many investors booked profits as prices peaked, leading to sharp mean reversion.

Crypto, too, had been consolidating after huge gains the previous year, and traders exited positions rather than hold through volatility.

4. Risk-off sentiment & global economic uncertainty

Geopolitical tensions, concerns about slowing growth and rising economic uncertainty have triggered broader risk-off behavior in markets:

- Investors tend to sell riskier, highly leveraged or speculative assets.

- Even assets traditionally seen as safe havens (gold, silver) were hit when liquidity dried up across the board.

This “everything sell-off” dynamic tends to happen during panic or systemic risk repricing periods.

Market & community reactions

Investor sentiment

Across social media and forums:

- Debates about manipulation: Some traders claim institutional actors or large banks influenced silver’s crash, pointing to specific futures positions.

- Mixed views on safe havens: Many retail investors were shocked to see gold and silver — long viewed as stable stores of value — plunge alongside crypto.

- Classic risk-off commentary on crypto boards blamed macro sell-offs and forced liquidations rather than fundamentals in digital assets.

Market player commentary

Professional analysts have weighed in:

- Some see BTC as oversold and expect rebound potential, while metals may be overbought in the short term.

- A few commentators noted that the drop in metals might reflect paper contract dynamics rather than physical fundamentals.

What’s next?

1. Crypto outlook

Bullish scenarios:

- If forced liquidations unwind and risk-appetite returns, crypto could rebound sharply as money rotates back into risk assets.

- Institutional developments (e.g., regulatory clarity or ETF flows) could revive confidence.

Bearish risks:

- Continued tightening monetary policy or dollar strength could suppress speculative assets further.

- Prolonged risk-off macro conditions could keep crypto subdued.

2. Gold & silver outlook

Precious metals prognostics are mixed:

- Short-term correction expected due to profit-taking and technical retracements.

- Longer-term fundamentals — central bank demand, inflation hedging, supply constraints (especially silver) — could support prices eventually.

However, sharp volatility is likely to persist as markets reprioritize risk.

A broader market repricing

This sell-off isn’t just about crypto or metals in isolation — it reflects a broader repricing of risk and liquidity across global markets:

- A stronger dollar and shifting rate expectations have pressured assets across the board.

- Forced liquidations and leverage unwinding amplified declines.

- Investor psychology — fear and de-risking — became a self-fulfilling spiral.

In times like this, volatility spikes, traditional correlations break down (e.g., safe havens falling at the same time as risk assets), and markets contest old assumptions.

For traders and long-term investors alike, these episodes are testing resilience and prompting deeper questions about where capital finds safety and return in an increasingly interconnected financial system.